Advanced Manufacturing Excellence

HonHo Jewelry, your premier source for factory direct jewelry manufacturing in China. Since 2010, we‘ve been providing exceptional factory direct jewelry solutions that combine traditional craftsmanship with cutting-edge technology. Our factory direct jewelry approach eliminates middlemen, allowing us to offer superior quality at competitive wholesale prices.

Crafting Excellence in Jewelry Since 2010

As a leading factory direct jewelry manufacturer, we specialize in translating diverse brand visions into trendsetting pieces while maintaining cost efficiency through our direct manufacturing model.

Heritage Meets Innovation

HonHo combines sophisticated manufacturing processes with expert craftsmanship in every step – from intricate mold design to precision casting and meticulous finishing. Our advanced production methods ensure each jewelry piece maintains exceptional quality and distinctive character that elevates your brand’s market presence.

Factory Direct Jewelry Manufacturing Excellence

Mold Making/Cutting

At HonHo, we seamlessly integrate advanced CAD/CAM technology with state-of-the-art manufacturing processes. Our dual-approach system combines precision mold engineering for intricate designs with direct CNC machining capabilities, offering versatile solutions for your jewelry production needs. Whether your collection requires detailed casting molds or direct fabrication, our technology delivers exceptional accuracy and consistent quality.

Investment Casting Excellence

HonHo employs the time-honored investment casting technique with modern precision. Our advanced silicone molding system, capable of over 1000 production cycles, creates flawless wax patterns that transform into exquisite jewelry pieces. Through our refined lost-wax process, backed by decades of expertise, we achieve superior casting quality while maintaining optimal production efficiency.

Each mold undergoes rigorous quality control, ensuring consistent detail reproduction and dimensional accuracy. Our specialized wax injection process minimizes material waste and maximizes production yield, delivering cost-effective solutions without compromising on quality.

Precision CNC Technology

Our factory direct jewelry manufacturing employs advanced CNC machining centers that combine Swiss precision with innovative digital control systems. Our multi-axis CNC technology achieves intricate details down to micron-level accuracy, creating distinctive jewelry pieces that stand out in the market. With our automated production capabilities, we efficiently handle both small custom orders and large-scale manufacturing demands while maintaining exceptional quality standards.

Polishing

HonHo’s proprietary finishing processes combine cutting-edge technology with artisanal expertise to achieve flawless mirror-like surfaces. Each piece undergoes our signature multi-stage polishing treatment, ensuring brilliant luster across both contemporary and classic designs. We stand behind our craftsmanship with an industry-leading 2-year finish guarantee, promising enduring brilliance for every piece.

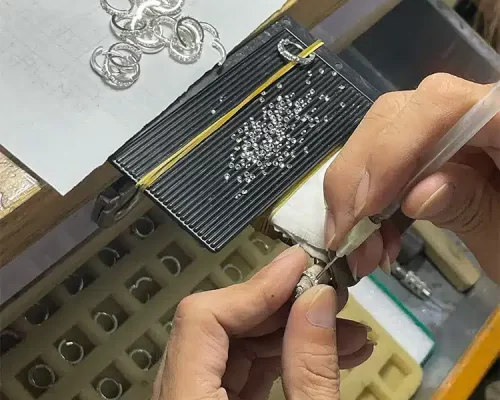

Precision Assembly

HonHo’s expert craftsmen employ advanced micro-welding techniques to unite intricate components with unparalleled precision. Each piece undergoes rigorous quality control during our seamless assembly process, ensuring structural integrity and flawless aesthetics. Our state-of-the-art joining methods create durable bonds that maintain both beauty and longevity in every jewelry piece.

Protective Plating

HonHo employs advanced electroplating technology to coat each piece with premium gold or silver, creating an impenetrable shield against tarnishing and microbial contamination. This sophisticated process not only enhances aesthetic appeal but also ensures lasting protection in any environment. Our medical-grade plating technology guarantees both stunning brilliance and complete peace of mind for our valued clients.

Artisanal Stone Setting

HonHo’s master artisans employ both traditional and innovative stone setting techniques to create stunning jewelry pieces. Using precision engineering and specialized adhesives, we securely mount precious gemstones and decorative elements onto our diverse metal collections – from luxurious brass and silver to contemporary stainless steel and brass designs. Each setting is meticulously executed to ensure both aesthetic excellence and long-term durability.

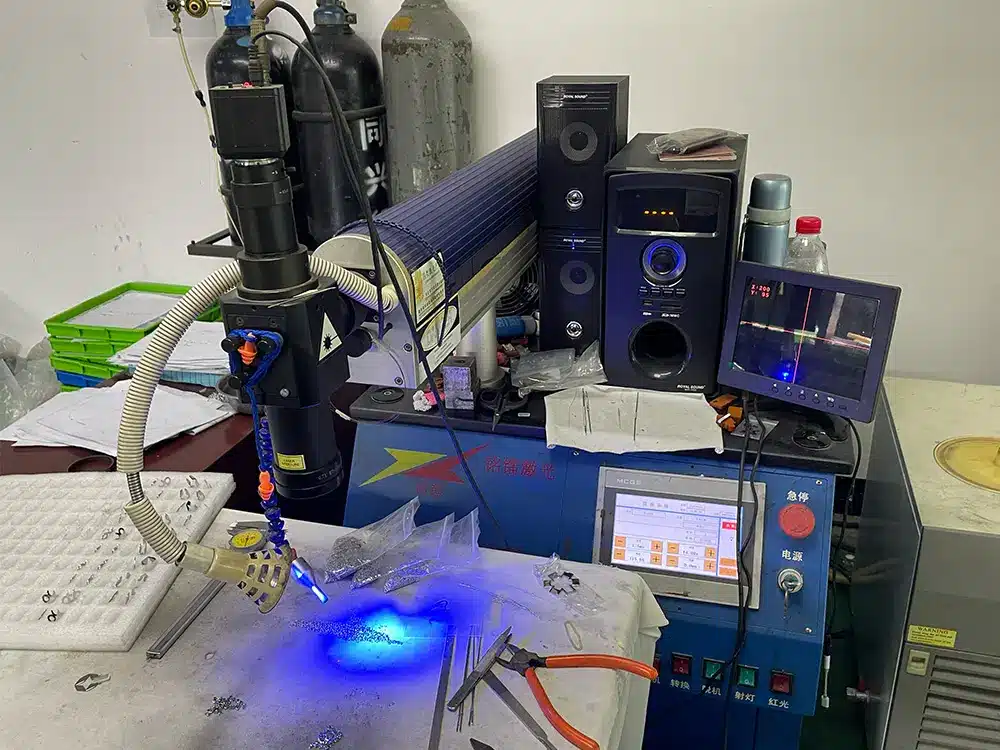

Precision Laser Engraving

HonHo’s state-of-the-art laser engraving technology brings your unique vision to life with unparalleled precision and detail. Whether you choose from our curated pattern collection or provide your own custom design, our advanced laser systems can recreate intricate details with microscopic accuracy. This cutting-edge process ensures rapid turnaround without compromising on quality, making personalized jewelry pieces accessible and affordable.

Quality Assurance in Factory Direct Jewelry Production

At HonHo, we maintain rigorous quality control standards throughout our production process. Each piece undergoes thorough inspection to ensure flawless craftsmanship and customer safety. Our premium packaging solutions not only protect your jewelry but also serve as a powerful branding tool, creating an unforgettable unboxing experience that elevates your brand presence in the market.

Benefits of Factory Direct Jewelry for Your Business

- Jewelry Brands

- Jewelry Wholesalers

- Retail Shops

- E-commerce

- Starting-up Brands

- Celebrities